The regulatory dramas in multi-level marketing are never ending, at least I don’t see that in the near future. Regulatory bodies like FTC have been keeping the direct selling especially the multi-level marketing industry on strict vigil for decades of course on the best interest of the consumers. But how good is it for the future of MLM companies?

FTC's recent “Delaware House Bill 162” and “Click-to-Cancel rule” are still on rounds in the US courts without a final judgment. These unsettled legal battles are viewed warily by companies for the potential of concerns it holds. How can MLM companies guarantee a sustainable future amidst the legal turmoils?

MLM companies who offer quality products without over promises, false claims, or strong emphasis on recruitment are surely off the FTC radar. What regulatory bodies such as FTC expect from companies is quite simple and straight forward.

- Pay your salespeople for sales to real customers.

- Keep your distributor's earnings transparent.

- Avoid unsupported product claims.

- Disclose incentive clauses to customers.

- Make subscriptions easy to cancel.

The importance of implementing these principles is not to just exempt yourself from legal trials but to create a loyal long-standing relationships with customers. Organizations like FTC are trying to make one point clear: Business success through transparency and consumer trust takes your business far and keeps it strong.

The industry has seen and been through a number of regulations and policies that have purged it of unethical practices and turned it into a credible business model. This guide is built on conclusions drawn from my years of experience in the direct selling industry. Consider this as a reference for decision making or a spec for building trust and compliance in a customer-centric direct selling business.

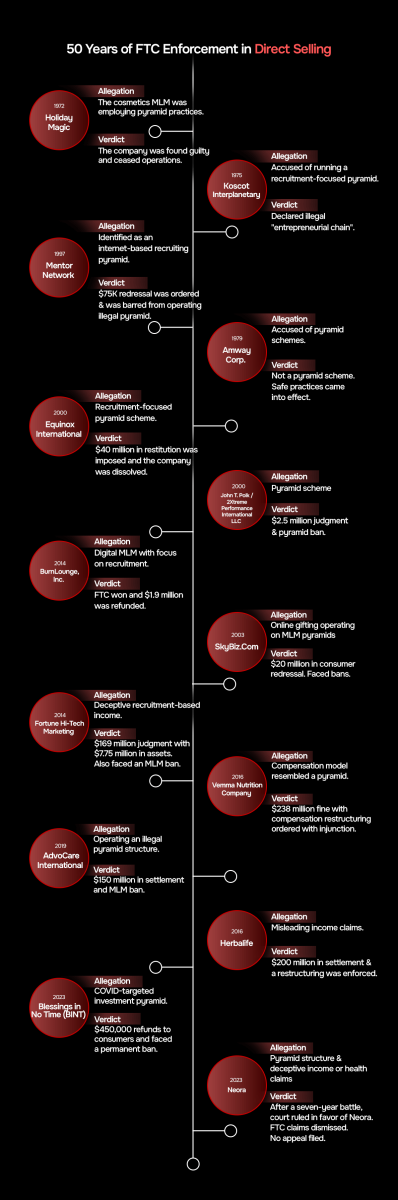

A snapshot of popular lawsuits: FTC vs. direct selling

The primary motive of FTC is to safeguard consumers. Every act and policy implemented is centered around this. Any harm to the consumer in any manner can throw the company into a legal whirlwind. MLM companies have witnessed great legal battles in the past and the present.

What we derive from the above timeline is that down the years, the legitimate ones stay and the illegitimate quit. Staying legitimate and true to your consumers is the best way to stay out of the blast radius.

A legitimate MLM in the eyes of FTC

MLM companies are often classified as legitimate by FTC on these specific grounds.

- You prioritize retail sales as the foundation of your compensation.

- You draw a clear distinction between your customers and distributors.

- Limit the payout ratio from personal consumption.

- Ensure distributors stay compliant within and outside the organization.

- Maintain a strict customer-to-distributor ratio.

Companies who fail to live up to these expectations are always on the regulatory radar and risks investigation, enforcement, or even shutdown.

Building a compliant MLM business in a regulated market

The secret to a compliant MLM business is not quality products or a motivated distributor network. It demands a clear understanding of the legal boundaries and regulations set by organizations like FTC. Compliance isn’t a checkbox it has become one of the core components that protects your brand against regulatory risks and builds trust among your network and customers.

Let us now analyze a practical framework which makes compliance a natural process of your MLM enterprise management.

Design a sales-driven compensation plan

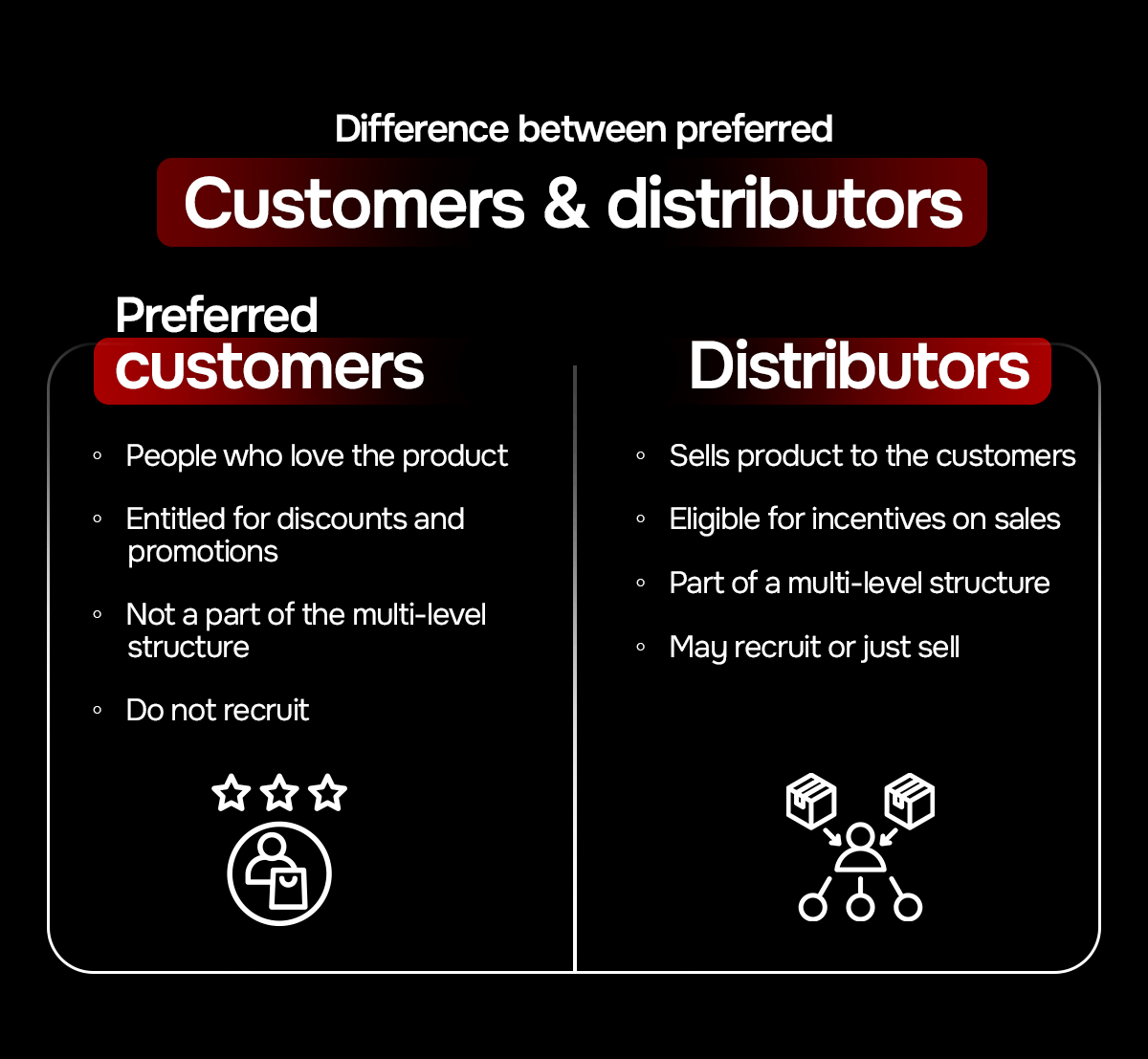

The basics of a sales-driven compensation plan lies in drawing a clear distinction between preferred customers and distributors. This distinction ensures that product demand is genuine and is not created by distributors to qualify for commissions.

The role distinction should be incorporated in your policy and software. If a person wishes to switch his role from customer to a distributor then the system should record the change with clear consent from the person involved. Everyone should earn the same points for purchases so that no one places orders through someone else to get extra rewards. Commission caps can help a great deal by limiting the commission a distributor can generate from personal purchases. This disciplines the entire network to focus on real retail sales not on gaming the system.

Measure the retail demand

The retail demand should be recorded and data kept ready for regulatory audits on each product sold. This will come handy when you need to prove the legitimacy of your compensation plan. The data also gives you an idea of which products perform better, how often people reorder, and which teams best serve real customers.

To put this in practice you will need a competent back office with

- Role segmenting feature that auto identifies customers and distributors with preconfigured criteria. Any role change will be recorded in the system with time which cannot be altered under any circumstance.

- Product transaction history which explains the details about every SKU, quantity, price, date, payment method, and customer identity for each sale.

- An audit system which can be referred for any transaction that happened at any point of time or hold commissions quickly as needed.

Such a system can efficiently track and report the share of revenue from real customer purchases, distributor-to-customer ratio, and up to what ratio does the compensation reward retail sales and personal purchases. This data delivered on a monthly basis on to your leadership dashboards tell a credible story to your investors and regulators.

Transparent income disclosures

Income claims are often used as a marketing tool to expand the network. What often goes wrong is the negative potential it holds for brands. Unsubstantiated or false income claims by distributors create complex legal hurdles for companies. Companies must maintain a transparent display of income potential while marketing an opportunity. Income Disclosure Statements (IDS) are made a mandate in the direct selling industry to curb the rise of false income claims.

Your income disclosure statement should depict what is real and what they can expect after joining your company. Keep the estimates to median income not average because top earner incomes can distort the average figure. Whenever income is mentioned on your website, in a presentation, or a distributor’s social media post, include a link to your income disclosure statement which lists number of distributors who have earned $0, how many earned $1000 or less, and what the median income was. You must also disclose all the costs involved in the opportunity.

IDS is not just like any other statement, it is a tool for building trust. Apart from the income numbers it should also include the time frame and distributor numbers taken to formulate the statement with a detailed explanation of how it is calculated and what it includes and excludes. Record your calculation method so that you can implement the same method consistently year-over-year.

To make this task easier for you, I have included a downloadable IDS template that has specific fields for entering the costs involved, medians, percentiles, how many earned $0 and how many above $1000. You can record this every year and post it as a PDF on your website. Ensure that any marketing or income claim is linked back to it.

Meet compliance and regulatory expectations with a ready-to-use Income Disclosure Template

Honest product claims

Whichever industry you are in, your product claims must hold valid scientific or substantial evidence to build trust. Scripted customer testimonials or false claims do not stand a chance to win the market. Especially in the health and wellness sector your product claims must be grounded in scientific evidence rather than personal stories.

Set up a simple process for approving these claims. This can help you to stay compliant and protect your brand.

- Categorize claims on the basis of reason (general wellness or disease-related).

- Each approved claim must have a proper supportive study.

- Create a centralized system to track what was cleared, when, and by whom.

- Let every marketing material have a compliance footer which your distributor cannot edit.

- Advice your distributors not to use medical terms or claim disease cures unless you have well-supported evidence or legal approval.

Bringing a serious approach to marketing does not affect creativity, it’s just that the clarity this brings helps them create trustworthy copy that won’t put your company into trouble.

Disclosure rules for partnership endorsements and influencers

Any paid promotion or partnership should be duly communicated to the consumer irrespective of the medium of partnership.

- Videos should include disclosure snapshots displayed long enough so that people can actually read it.

- Live streams should announce the partnership audible enough for the participant to hear it.

- Short captions should mention the partnership relation in clear and simple language.

Content management system can handle this with compliance management features that can automatically insert compliance disclosures where needed. These systems can also track what was posted by whom and when and identify high-risk posts. Put these as clear mandates in your partnership agreement so that you can take back the money or cancel the deal in the face of non-compliance.

Easy-to-cancel autoship programs

Autoship program is a great option to ensure consistent revenue and ensure ease of shopping for customers. But many companies use it as a tool to trick customers. Many a times these programs take the role of negative option marketing where orders are shipped repeatedly until a customer actively cancels or opts out of it.

Companies welcome customers to autoship or subscription services with just a click, the same should apply in the cancellation process too. Customers should be able to opt out without having to call a support center or wait in a live chat queue or juggle through web pages.

You must also ensure that your checkout process clearly explains the terms and conditions without any pre-checked boxes. Getting clear consent from customers before every autoship order and keeping the record, just in case something turns up in the future.

Setting the standards through training and mentoring

Developing a disciplined approach from your distributors can be achieved through proper training and mentoring. Because in the eyes of regulators, what a distributor says is what you say. To get this straight you must design a distributor training process that covers all bases.

- Train your distributors before they become eligible for commissions.

- Educate them efficiently on everything related to income claims, product claims, compliance policies, endorsements, and autoship disclosures.

- Monitor their social media activities for compliance violations and alert them when necessary.

An AI-driven distributor training system can help you with keyword filtering of questionable distributor content before it goes live. AI-powered compliance moderation feature in these systems can alert admins to take necessary action promptly. Enforce strict actions for constant violators like holding back commissions, warnings, temporary suspensions, or even termination. Most often distributors break rules out of excitement and not with the intention to cheat. When rules fall in place, compliance naturally follows.

Measuring the compliance health of your MLM business

There are four key metrics to assess if your business is safe and sound from legal and compliance related risks.

- 1. Revenue from real customers tells you if customers are purchasing your products not distributors for commissions.

- 2. Distributor-to-customer ratio – A healthy distributor-to-customer ratio signifies that your network is growing within the compliance boundaries. It also shows that people join your brand for the love of your products not just for the business opportunity.

- 3. Compensation balance – If your compensation plan balances personal purchases and retail sales then it is functioning as it should be.

- 4. Moderation response time – The sooner you take down violative posts, the lesser the chances of consumer harm and regulatory exposure.

Monitoring and recording the numbers periodically can help improve the compliance score of your organization. If the numbers drop, understand it’s time to give your compensation plan a tweak or set your training right.

You can alternatively use a compliance checklist template to measure the compliance health of your organization. The template sheet has an in-built tracker with Area, Control, Owner, Frequency, Evidence, Status, Notes, Last reviewed tabs so that you can easily manage compliance moderation, assign users the responsibility to oversee activities, and store proof for the future.

Ensure every process in your multi-level marketing business meets regulatory standards with our expert-backed Compliance Checklist

Addressing the most common concerns in the process

Entrepreneurs often wonder if a compliance feature or tool implemented is doing the right job. A thousand unsettling questions and wary about the risks involved?

Here I am penning down a few questions entrepreneurs often ask when it comes to compliance and regulatory management in MLM.

Do personal purchases of distributors count toward rewards?

They can be a criterion to earn commissions but there are steps you can take to keep it in the safe limits. Introduce a plan cap that restricts personal purchases towards reward consideration and promote rewarding retail sales.

Is a “paid partnership” tag enough to act as a disclosure?

It can be helpful but not really sufficient. As discussed, disclosure formats should be modified based on content formats. Ensure that your system has it pre-configured for each content type so that it auto-applies at the end of the content generation process.

Is it appropriate to advertise big incomes if someone achieves them?

You can celebrate your distributor achievement, but you must present them in such a way that viewers understand it is the story of one individual not everyone in the network. Tell your viewers the fact there are also people who have earned $0 or less than $1000.

Do we need a “negative option” policy even if cancellations are made easy?

Making subscription cancellations easy for customers is part of the mandate. Better yet still, having a formal well-drafted policy record with terms and consents can back you in times of trial.

Discover how we build resilient businesses with advanced MLM functionalities

A practical 90-day template ready to execute

Now, having discussed and understood the need to have a proper plan in place, let’s see how to put this into your already established business. Establishing this mid-way is not going to break your processes or affect your network productivity. This will reinforce the trust and confidence customers and distributors already have in your business.

Take the first 30 days to assess and design

Analyze your compensation plan for compliance gaps and set clear role distinctions for customers and distributors. Remove payouts meant only for recruiting and set a strict limit on rewards for personal purchases.

After the assessment, move on to analyze your back office to know if it can record every sale-related data including customer identity. Carefully develop your income disclosure statement and assign users who should update it every year.

Implement solutions to your findings starting day 31 to day 60

Once you identify the gaps and find solutions, record it to train your network. Tell them the dos and don’ts and adopt strict measures for violations. This phase is going to be a little tough for your existing distributors but make them understand the gravity of the situation.

Publish updated policies and include them in your training process. Ensure commissions are paid to distributors only after completion of mandated training programs. Monitor social media for content that violates the standards set and alert the violator with strict warnings or actions.

Autoships should be made easy to cancel and priority given to related customer concerns. Every cancellation should be recorded with consent and renewal reminders sent in case the user continues with the subscription.

Monitor and optimize the process from day 61 to 90

Now is the time to ensure if the steps and processes you have implemented are working fit and fine. Run an audit to check distributor activity centered around retail sales and personal purchases. Record what went wrong and correct it before moving forward. Build a compliance dashboard with the four key metrics (e.g., retail revenue, customer-to-distributor ratio, etc.) and make this accessible to the board or leadership.

Share the changes openly with your customers and distributors because it builds trust and loyalty.

In the course of understanding FTC expectations, we have indeed designed a concrete plan to build a fully compliant multi-level marketing business. Regulations are there for a reason and remember it is not here to hamper your performance. They are a means of building trust and establishing businesses that live the long term without harming consumer interests.

Key pillars of compliance such as verified sales, transparent income disclosures, ethical endorsements, and easy cancellations, will turn from mere processes to signals of integrity winning customers in every step and creating best ambassadors out of your distributors.

Leave your comment

Fill up and remark your valuable comment.