IEO is a popular word of talk among the crypto community. The impact of technology and innovations in the crypto world has given way to adopt new fundraising models.

The absence of the right funding option often places us in many crucial situations. Though with a proper idea and plan, many companies failed to raise enough funds for their Crypto projects. At this point, IEO gains the market.

What is IEO?

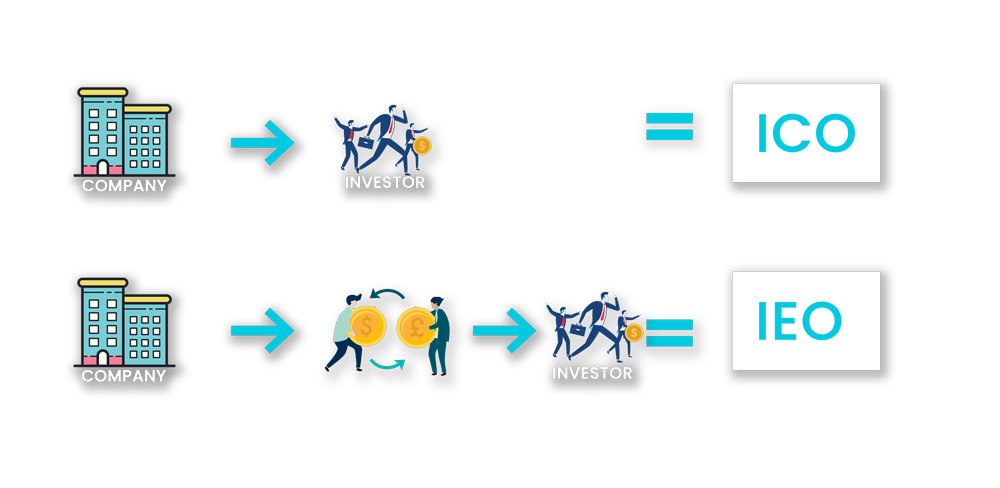

IEO, Initial Exchange Offering is an evolutionary crowdfunding model. IEO’s emerged as a secure fundraising system, where ICO’s failed to succeed. There is a main difference between ICO and IEO. In the case of ICO’s, the company directly approaches investors to raise funds whereas, in IEO, the company approaches a cryptocurrency exchange.

The exchange lists the project after a deep evaluation of the project. The exchange further proceeds with promotional activities to make the IEO public.

IEO - a game-changer in fundraising?

Initial exchange offering is a novel crowdfunding mechanism introduced in the blockchain industry in order to raise funds for crypto-based projects.

IEO eliminates major issues in fundraising

- Trust or Credibility issues

- Legal issues

- Due diligence is assured

IEO tends to offer:

- An improved layer of security

- Greater transparency

- Benefits to new companies

IEO and Economy

- IEO brings new and good projects to the market.

- The market determines the quality of the project.

- High-quality projects will make better market liquidity

How IEO works?

- An improved layer of security

- Greater transparency

- Benefits to new companies

IEO and Economy

- IEO brings new and good projects to the market.

- The market determines the quality of the project.

- High-quality projects will make better market liquidity

How IEO works?

The company or startup approaches a crypto public exchange with the project. The details about the project will be detailed in the white paper.The exchange will evaluate the project in order to ensure authenticity. Otherwise, it will affect the reputation of the exchange. After whitepaper screening, the exchange and the company mutually make an agreement.

The projects are then listed and launched in the exchange ensuring no scam is involved. The exchange will take the responsibility to launch and move with promotional activities. The project team will also make necessary contributions in the marketing side inorder to make fundraising process successful

The company or the project team has to pay a fee to the exchange, one at the time of listing and when a certain number of coins are exchanged. At the same time, the project team can save marketing or promotional expenses as most of the marketing is done by the exchanges itself.

The project, Exchange, and Investor gets benefited

- A very less time needed for token sales as the exchange makes the token public and promote it.

- The exchange conducts an easy KYC/AML process and it will help the company as well as the investors.

- The exchange conducts due diligence on the company and ensure the authenticity of the project

- When tokens are listed in a popular crypto exchange, a large number of users will have access and the fund can be easily raised.

- An investor will find it easy to invest in an IEO as he/she just needs to start an account on the exchange and undergo a KYC process

- The company will go through a due diligence process and hence the investor need not have to worry about the security

- The company will get access to a large user base of the exchange platform and it helps in a good token sale

- Exchange can get access to a new range of coins and thereby expects an increase in the revenue.

IEO vs ICO

| Factors to compare | IEO | ICO |

|---|---|---|

| Account | Direct login to Exchange account and participate in fundraising | Sign up in the exchange using ID or undergoing KYC process |

| Accessibility | Those who have an account in the exchange can participate in the IEO event | Anyone can participate to raise funds for a crypto project |

| Trading Speed | Trading happens quickly | Time-consuming as it needs to analyze the project |

| Token reliability | Exchange ensures the reliability of the token and the issuer | An investor needs to ensure the reliability of the token |

| Trust | Exchange stands as a trusted third-party and ensures the authenticity of the project | No authenticity is verified. The investor needs to ensure it |

| Vetting the project | Cryptocurrency exchange using KYC/AML | The investor needs to verify the project or depend on any third party to verify |

| Promotion | The exchange will take care of the promotional activities. The company too can market the IEO by listing in private exchanges or sharing exchange listing links | Need to reach a large number of people spending a lot of time and effort. |

| Security | Higher security as the exchange verifies the project or it will affect the reputation of the exchange | The investor ensures the security. Otherwise, funds get manipulated |

| Risk | Exchange verifies the validity and relevance of the project in order to safeguard the reputation of the exchange | Investments are a bit risky as the project may be some fraud or without any legal backing |

| Liquidity | Higher liquidity as the exchanges validate the project by screening the whitepaper and it will attract investors | Lesser liquidity as the investors need to put extra time and effort |

| Transparency | The higher level of transparency as the company needs to share a whitepaper detailing all the information related to the project | Lesser transparency. The company need to provide very little information about the company and present a whitepaper |

How IEOs can be organized trouble-free?

- Choose the platform wisely. Some exchanges who are not much concerned about their reputation, often tend to play fraud.

- Follow self-marketing strategies. Some exchanges may give preferences to well-connected projects and make promotions accordingly.

- Choose the platform considering the listing fee. Startups or first-time fundraisers may not be able to afford the listing fees at times.

- Be careful of price manipulation. There may be chances that the price may be manipulated by the exchanges.

Listing tokens in the private exchange

The tokens need to be popular even before listing in a public exchange. The company lists a limited number of tokens in a private exchange and sell them. The company can make promotions to invite more potential investors. In a private exchange, the tokens will be distributed within the company in order to gain early access. Even the tokens can be exchanged with altcoins like BTC, ERP, etc. and fiat currencies like USD, EUR, etc.

IEO - Facts and figures (2020)

- The IEO model was initiated by Binance.

- The first IEO was launched in 2017.

- IEOs raised $1.7 billion in 2019

- Top five countries with the most IEO projects are the USA, Estonia, Singapore, South Korea and Hong Kong.

- These top countries raised a total of $1.45 billion USD.

- Top three IEOs are Matic, BitTorrent and Harmony.

- Latoken, ProBit and p2pb2b were the most popular launchpads by number of projects.

- Bitfinex, Latoken and Binance were the most popular launchpads by funds raised.

- The best performing market sector was protocols followed by blockchain services and entertainment.

Discover how we build resilient businesses with advanced MLM functionalities

Epixel putting best to bring innovations and a lot of contributions are made in the software industry. Join hands with the team for all the IEO services from website development to public exchange listing. It includes Pre-IEO services, IEO crowdsale services, Post IEO services. As an extra service, we also provide Private exchange platform development, MLM integration with private exchange, Mobile wallet development etc. Raise funds for your IEO project trouble free. Also, you can explore different ico software development company that delivers cutting-edge solutions to help startups launch their initial coin offerings effectively.

Leave your comment

Fill up and remark your valuable comment.