Payout cycle in MLM is not a financial schedule, it is a trust signal. Distributors look at the payout cycle as a value factor, for them it defines how much and how well a company values their contributions. Shorter pay cycles paid weekly or fortnightly keep the motivation high and speeds up time-to-first earnings but drains the revenue and increases operational risks. Longer payout cycles, usually monthly, secure your revenue but can disengage new or struggling distributors.

Long vs. short is not the debate. Our aim is to build a perfect payout cycle that can balance distributor lifecycle, revenue, and risks. Companies are often uncertain about the duration of the payout cycle as to whether it should be weekly, biweekly, monthly, or a reliable blend of these. Priorities remain on revenue and compliance but boosting motivation cannot be compromised too.

We are here to create that impactful blend which increases distributor lifetime, reduces risks, and sets the revenue on a consistent line.

Balancing the benefits and the costs

The perfect payout cycle comes at an expense, your distributors or company’s capital. The balancing act hence calls for careful consideration of these factors.

Distributor motivation

This stands as a determinant to the efficiency of the payout cycle because when they are paid faster, they are more likely to sell higher.

Revenue flow

The capital pulse should be kept in check as faster payouts impact it sooner with a rise in fees, support tickets, and fraud risk.

Increased risks

Quicker payouts make it difficult to detect policy violations and maintain compliance. Returns and chargebacks during the cooling-off periods create a strain in the payout process.

The focus should be to find the shortest yet reliable payout cycle length that ensures financial discipline and compliance.

A strategic payout design to drive motivation and reduce risks

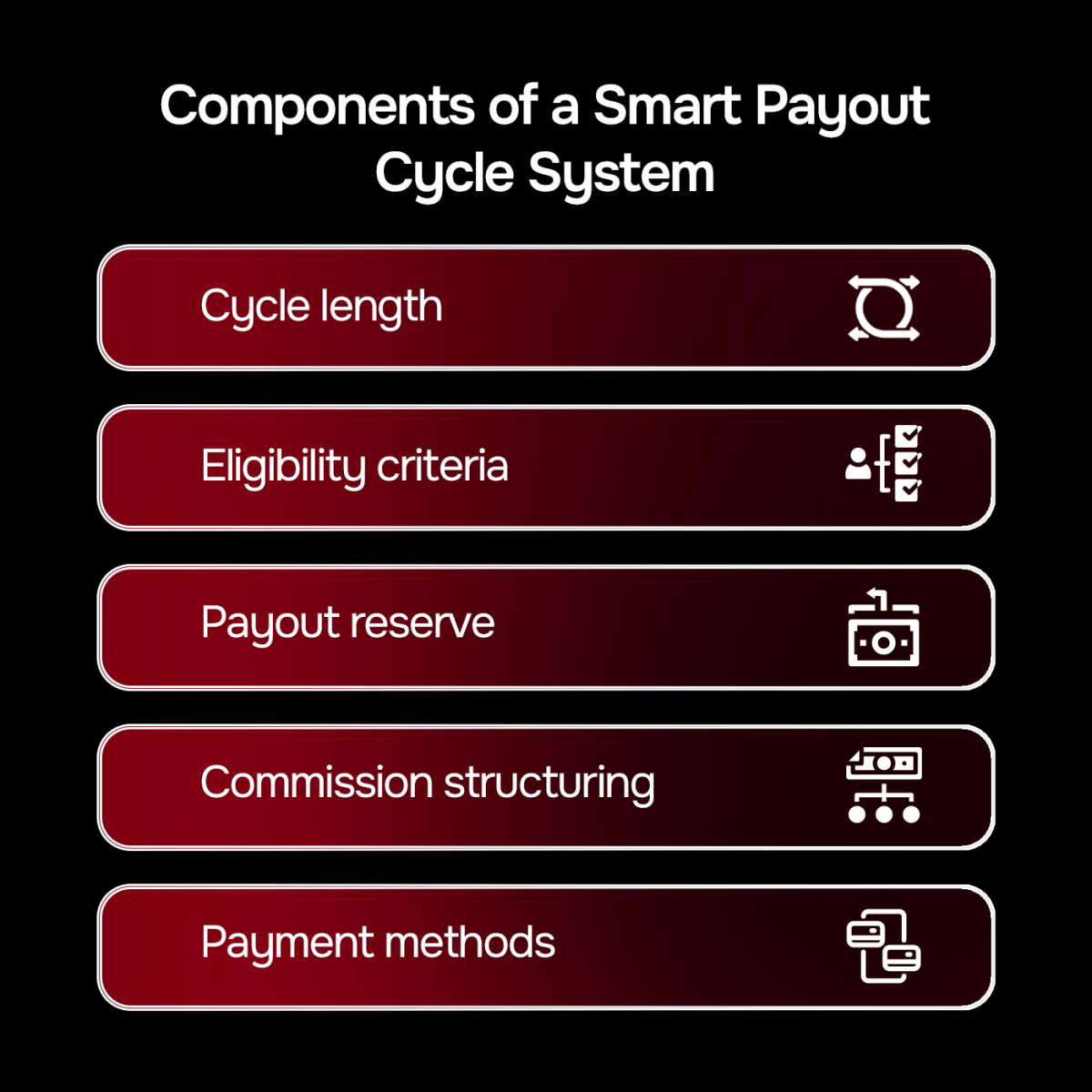

Payout intervals, whether long or short, is still in question but more important is the foundational design that is efficient and free of risks. We are breaking down the process of building the perfect MLM pay cycle into five different components.

Cycle length

The length of each payout cycle can be weekly, biweekly, monthly, or hybrid. Analyze your teams and introduce a shorter pay cycle where motivation is necessary. Set longer pay cycles where costs and risks are higher. Identification of risk factors is crucial to implementing the right cycle length.

Eligibility criteria

Faster payouts must be set as a privilege for distributors with completed KYC verification, basic training, and real customer orders. Distributor accounts with a very good track record may receive premium payout benefits to encourage compliance and ethical practices among sellers in the network.

Payout reserve

In order to reduce the risks of chargebacks, returns, or cooling-off periods, you can temporarily hold back a part of the payment. This “safety buffer” ensures that legitimate earners are not punished, and safeguards cash flow and brand credibility.

Commission structuring

Multi-level marketing has different types of commissions, bonuses, and incentives, each having its own set of risks and complexities. Direct, low risk commissions like customer sales and retail commissions can be processed faster and higher risk, complex structures like team overrides and structural bonuses should be processed carefully in a controlled way. Comparing payout speed with risks can ensure fairness in the process and reduce financial crises.

Payment methods

International payouts need globally compliant payout systems. E-wallets can give distributors a full view instantly into their earnings with actual cash-out processed later. They are low on additional fees and other legal hassles.

A payout well-structured performs well on compliance, motivation, and revenue without unexpected risks or operational failures.

Practical payout approaches

Everything is easy in planning, implementing is tough. Like every other process designing a payout cycle cannot be a one-size-fits-all approach. Startups will have to take on a different strategy from that of enterprises, both these approaches might not work for a small or medium sized business.

Weekly payouts

This works well for new market launches and retail-based commission models with a focus on motivating distributors and faster growth. Companies with enough capital reserve to manage sudden turnaround and a security framework to detect frauds. This, however, increases payout processing costs, support tickets, returns, and refunds.

Biweekly payouts

Good to implement for established markets and moderate retail who want a balance between fast (weekly) and slow payout cycles (monthly). As compared to a weekly cycle it is low on costs and less risky but frequent enough to motivate distributors.

Monthly payouts

Companies with complex rank rules, longer return windows, and commission structures are better to run on monthly payouts. This brings operational efficiency and clarity in reconciliations. A lighter downside of this approach impacts the new distributors because it increases their time to first earnings. Financial discipline and reduced risks are the highlighted positives.

Hybrid payouts

Hybrid models are created from the perfect blend that complements the needs of the organization.

- FastStart programs for distributors who are in their 60-90 days get weekly payouts and further change the payout cycle length to biweekly or monthly.

- Split the cycle with commissions for retail sales paid weekly or biweekly and team bonuses held until the end of the month.

- Opt for “Wallet-then-cash" rule wherein daily earnings reflect instantly on the distributor’s e-wallet but actual cash transfer is processed once or twice a month to control costs.

- Set payout restrictions like allowing weekly payouts only if a distributor’s earnings go above $50. Otherwise maintain biweekly or monthly payouts. This also reduces inefficiency.

Hybrid payout cycles often score well above the other ones for it creates the right balance in controlling risks and finances to improve efficiency and motivation.

Payout planner

Strategize your payout cycle depending on your current business situation. This payout planner is designed for MLM businesses in various stages of growth. Picking the right cycle decides the efficiency and future of your direct selling business.

| MLM payout cycle planner | ||

|---|---|---|

| Business case | Recommended cycle | Results |

| Launching a new product or entering a new market | FastStart hybrid | Increases referrals and motivates new distributors with early wins. |

| High retail or low return risk | Weekly retail + monthly overrides | Real customer sales reduce risks and refunds. Monthly payouts for leadership teams ensure structural balance. |

| Tight cash reserve and high transaction fees | Biweekly | Maintains cash discipline and field engagement. |

| Complex plan and long return windows | Monthly | Enough time to calculate ranks, handle returns, and process payouts without overpayments. |

| Attrition rates high among new distributor segments | FastStart or biweekly | Fast payments ensure retention and early quits. |

Risk control methods to keep your plan safe

Once you choose your payout cycle, it is important to analyze the possible complications that might arise along the way. You cannot predict all complications but there are a few that are common and critical.

Compliance safeguards

Do not encourage inventory loading and self-purchases. The payouts should be linked to actual customer sales and support.

Cooling-off protection

Stay vigilant on transactions with long return windows. You can hold back a small part of the payment until the cooling-off period is completed.

Fraud checks

Always ensure that KYC verification is complete for all customers and distributors in your network. This reduces purchase frauds and fake transactions. Do not rely on a single channel for payout processing, always keep options to save payout interruptions.

Lower transaction fees

Whenever a distributor successfully completes a sale, process their rewards instantly to reflect in their e-wallet or earnings dashboard. You can transfer the actual amount in cash to their bank account after a stipulated time of accrual. One-time payment reduces transaction fees compared to multiple payments but also builds motivation and trust.

Simple rules

A payout system works well when everyone in the loop understands how they are being paid. When commission rules are complex or there are so many policies tied to payouts, distributors get confused and increase support tickets and errors.

Keeping these risks under control can improve the health of your payout cycle and compliance.

Worried about your current pay cycle health score?

Use our Pay Cycle Health Scorecard to analyze.

Practical risk rules for ensuring payout health

Analyzing every possibility that can threaten or strengthen your payout process creates the space to make the right decisions during a crisis. Let us consider some If...Then scenarios that might take you off guard.

- If you see an increase in new distributor churn rates or the time-to-first-earning is rising, then instantly activate FastStart weekly cycle for 60 to 90 days.

- If transaction fees go beyond your set limits, then opt for wallet accrual and biweekly payouts.

- If refunds increase, then hold back a portion of the payout on products most likely to be returned. Release it after the return window.

- If the complexity of payout policies increases, then publish a clear payout policy and remove conflicting promos.

- If policy abuse is detected, then link fast pay only to real customer orders and make KYC verification mandatory.

- If top earners report a delay, then update their dashboards with real-time earnings view and a clear payout schedule. They will trust the consistency.

Discover how we build resilient businesses with advanced MLM functionalities

A 90-day plan for developing the perfect payout cycle

Set-up-a-plan-and-execute approach will not work when designing an MLM pay cycle for obvious reasons—complex payout rules, extensive distributor networks, and global markets. Hence only a careful strategic design can ensure a healthy and sustainable payout cycle.

First 30 days

Take this time to understand your goals, prepare and set a starting point. Pick your payout policy, that is which payout cycle or policy you want to test. Keep it simple and to the point. Measure your current metrics like time-to-first-earning (TTFE), retention score, processing costs you are already paying, your cash reserve, and the number of support tickets logged each month. Keep your leaders, field, finance and compliance teams in the loop so that everyone understands the plan, approves it, and identify any risks early.

The next 30 days

Once the policy is set, test it within a region or distributor segment. Keep payout rules simple and announce the dates in advance so there is no confusion among distributors. Track metrics like TTFE, retention rate, processing fees, and support tickets weekly. Include a survey among distributors to see the practical side of your implemented policy.

The last 30 days

If the metrics and survey results show a green flag, then implement it completely. Compare the pilot results to analyze the impact and confirm that there are no risks related to compliance and operations. Communicate the new policy implemented, FAQs, and timeline to the entire organization. Set up new review cycles every quarter to ensure safety, compliance, and network growth.

Need a quick solution to all your payout troubles? Fix it with a clear, proven policy.

KPIs that decide the health of your payout system

Implementation of every strategy calls for continuous monitoring and improvement. When it comes to monitoring, it is important to concentrate on the right set of KPIs, not tracking metrics arbitrarily.

Time-to-first-earning (TTFE) for new distributors

Shorter TTFE motivates distributors more and reduces early quits. If this is longer, then you must introduce FastStart programs or increase the frequency of retail payouts.

Active sellers (Months 2-4) and early churn

Track active sellers in months 2-4 after joining and the percentage of sellers who leave the network early. Early retention shows your network’s health and a drop in the number of active sellers suggests an improvement in incentive structure or support system.

Refunds or chargebacks as a percentage of GMV

High refunds and chargebacks create a financial risk for your business and make fast payouts threatening the sustenance of your business. Set a safe percentage limit for your gross merchandise volume (GMV) and analyze if holding back a percentage of commissions or delaying the payout helps.

Transaction fees as a percentage of commissions

Frequent payouts or multiple payment methods can add up processing fee. Identifying the percentage of fees to actual commissions can help establish a cost-efficient payout process.

Capital reserve strength

Cash reserves in terms of days of payouts show you how long can you go without any incoming revenue. A higher buffer can handle emergencies well even with fast or hybrid payout cycles. A thin cash reserve may need slower payout cycles or controlled payouts.

Payout-related support tickets

Count the number of issues, complaints, or questions raised regarding payouts. The higher number of tickets may be due to inefficient communication, complexity, or errors.

Field sentiment surveys

In order to keep your payout cycle healthy, you must know your distributors’ feelings about the new changes in the payout process. Even when the rest of the metrics look good, there might be reduced engagement retention. Running regular surveys can help you identify these concerns early.

Conclusion

A well-structured payout cycle balances cost, confidence, and compliance. Reward activities that build early trust and motivation faster, slow down to protect cash and credibility. A healthy payout is not just about paying on time, it is the linchpin that holds together your brand’s trust, reputation, and financial stability. When the rhythm of cash aligns with the rhythm of sales, distributors stay engaged and compliance stays clean.

Leave your comment

Fill up and remark your valuable comment.