Synopsis

One of the critical necessities for mankind in the unpredictable future is insurance. From safeguarding human lives to securing every tangible asset, insurance is considered as a prudent investment choice by people across all age groups.

Once the least explored opportunity within the field, the insurance and investment sector are now widely considered as a potential sector by the direct selling industry. However, with enormous computations and calculations involved in the business, numerous permutations, and combinations to finalize policies and get the business up and going, an MLM insurance business requires 360-degree coverage.

Problem

An MLM insurance business had to streamline its operations with an inclusive framework to efficiently manage its network of sales agents and automate complex calculations. Fragmentation occurred while managing sales across various platforms leading to data silos, a lack of real-time insights into agent performance, and sales metrics were to be addressed to overcome difficulties in scaling operations and managing growth.

Lack of agent confidence and persistent decline in their performances led to the need for integrating agent management features

Solution

First things first, identifying needs pertaining to the brand, how to improve its efficiency and agent satisfaction and enhancing decision-making capabilities are the key territories that need vigilance for improved growth and success of the business.

Epixel MLM Software conducted a thorough assessment of existing systems and processes and identified what are the key functionalities required in a comprehensive platform like unified agent management, automated calculations, real-time reporting, and scalability.

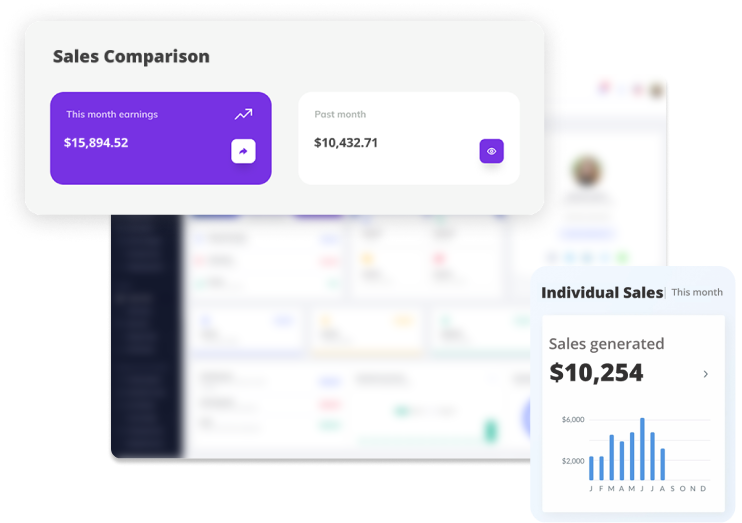

Efficient management of compensations

Commissions and compensations being the soul of an MLM business, aligning the same with the goals and objectives of the customers held prime importance. We reworked on the brand’s commission strategy removing complexities and confusion and ensured that it is flawless, flexible and scalable according to the expanding capacity of the business.

We also addressed the major business concern of the customers where most of the calculations were done manually leading to errors and discrepancies. Integrating commission management feature helped the business calculate commissions based on various classifications that ensures meticulous payout in stipulated time.

The feature also lets users set preferred payment options bonuses and commissions like bank transfers, cash payments, cryptocurrency payment, etc. With numerous transactions expected to happen on a regular basis, payments and transactions were source-to-destination encrypted guaranteeing trust and transparency. Also, to ensure advanced safety, all transactions were set to industry-standard PCI DSS compliance.

The end result? Sales agents gained trust and loyalty to the brand and a highly productive and motivated salesforce that yielded better sales and a higher rate of success.

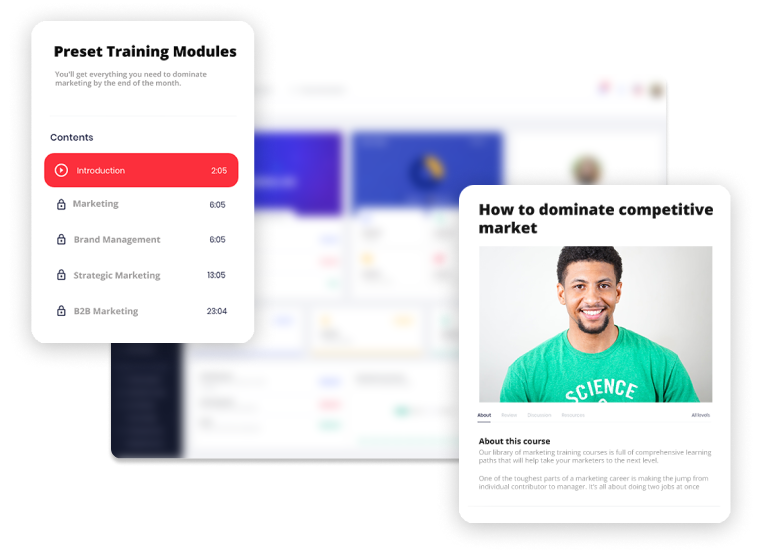

Enhancing agent skills

Beginning from scratch, we integrated streamlined onboarding for agents to gel well with the organization and get acquainted with its products, policies, and processes. This helped agents have a quick grasp of the organizational environment and adapt to it faster. This was followed by agent training to ensure that they stay updated with skills and enhance their capabilities for the growth and success of the business and their career. Continual learning through systematic training and feedback helps insurance agents gain confidence to tackle new business challenges and enhance their productivity.

From our expertise and experiences, we believe retaining is as important and tough as acquiring and hence, agent engagement was slid into the framework to keep them efficiently engaged, motivated, and most importantly valued. Retain their knowledge effectively with gamified learning modules and engagement tools, leaderboards, and certifications thus building a thriving bond with the agent force.

Genealogy tree

For the diverse amount of branching, sub-branching, and numerous coordinates involved in a direct selling insurance business, we observed that a genealogy tree is a necessity. Integrating the genealogy tree feature assisted agents and managers visualize their downlines and track their performances. The feature also facilitated identifying potential agents and thus expanding their downlines strategically.

The feature enables the business to improve its communication among the downlines, provide them with timely support, and training, and keep them engaged with the brand effectively for a longer period. The genealogy tree is an efficient element that helped the brand track sales and agent performance, thus making it easy to identify top and low performing agents.

Policy customization

Unlike other businesses, the insurance sector has diverse verticals to fit in customers according to their needs and preferences. However, person A would want a policy as laid by you, person B would want omissions, and person C would want additions to the policy mandates and conditions. Being unable to tweak policies could fail the business by losing customers.

With dynamic customization, businesses could tweak the policy to their customer’s liking, through a user-friendly interface having drag-and-drop features which eases and creates error-free policy customization.

Sales prospecting

For the amount of competition that exists in the insurance sector, finding the right customer could be a herculean task. This is where we seeped in our advanced sales prospecting feature that helped the business identify quality prospects from across various social media handles of the brand, who were then meticulously tracked and converted into leads.

The feature also helped the business stay war-ready for any prospect enquiries over email, social media or any other mode of communication.

Customer segmentation

A policy comes into existence after numerous stages and innumerous ifs and buts. However, with customer segmentation we were sure that it wouldn’t go wrong. This feature enabled the business to help track their customer preferences based on their requisites and cater to them with curated policies and efficient policy management.

From the inquiry stage until the policy is through, segmentation tools filter customer data based on their demographics and history to make informed decisions and deliver personalized policy choices. This also helped simplify policy planning than bombarding customers with numerous choices causing a delay in finalization and leaving the customer in utter confusion.

Customer Relationship Management (CRM)

After creating a comprehensive fencing incorporating all the necessary features for the business to revitalize itself, we kept our focus tight on integrating an efficient CRM system to ensure that the business does not lose its customers in the due course of the process. From the pre-trial phase, until the policy is finalized and recurring renewals and claim requests are attended to on and off, it would take a village to manage contacts and communicate with them effectively. But with a sophisticated CRM system, reaching out becomes effortless with timely contacts, member management, follow-ups, conversions, reminders, and notifications in an all-in-one platform that is efficient, automated, cost-effective, and result-oriented.

Challenges We Faced

Transparency and credibility being the two major pillars of a direct selling insurance business, our main focus was on reviving the business with its existing customers intact. We analyzed how customers flowed into the channel, tracked bounce rates, identified reasons why customers walked out midway, and focused on long-term customers. Leaving these intricate elements unnoticed weighed heavily on the business.

Lack of real-time insights into agent performances and sales metrics impacted agent confidence which harmed their productivity and ideally the growth and success of the business. It took us a while to track down the disconnect between the brand and its agents and how to energize them and get them to do business.

While working on installing a new framework, we also did a competitor analysis and thorough market research to understand the potential capabilities of the business that can accelerate growth and help the brand flourish.

Expected Results

Increase in agent performance

14%

Increase in sales

21%

Improved customer relationship

19%

Reduced agent attrition rates

33%

Increased results from targeted campaigns

46%

Efficient compensation calculations

100%

Reduced customer churn rate

29%

Increase in agent performance

14%

Increase in sales

21%

Improved customer relationship

19%

Reduced agent attrition rates

33%

Increased results from targeted campaigns

46%

Efficient compensation calculations

100%

Reduced customer churn rate

29%

Give your business a comprehensive facelift integrating advanced sales management techniques in one go

Free Demo